The Canadian housing market has been a rollercoaster over the last few years. From the record lows of the pandemic to the aggressive interest rate hikes that followed, homeowners and prospective buyers have been caught in a cycle of “wait and see.“

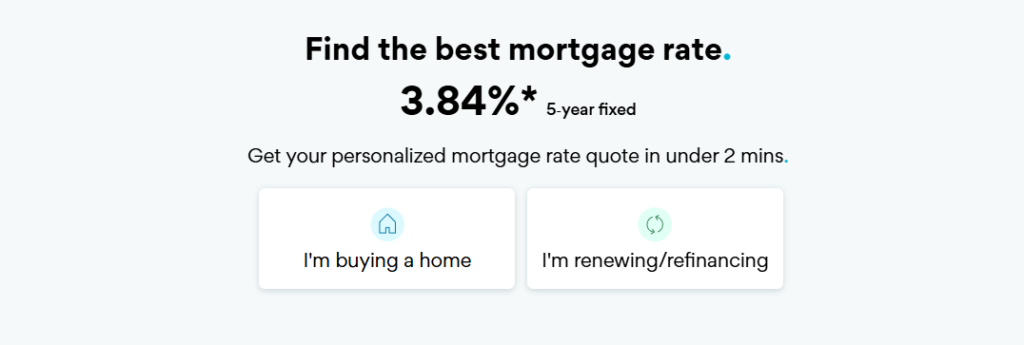

However, the wait might finally be over. In a move that has sent shockwaves through the financial sector, Ratehub.ca has just announced a 5-year fixed mortgage rate drop to 3.84% officially the lowest 5-year fixed mortgage rate available in Canada today.

Whether you are a first-time buyer looking to break into the market or a homeowner facing a daunting renewal, this shift represents a massive opportunity. In this guide, we’ll break down why this rate drop matters, how it compares to the “Big Banks,” and why the platform behind it is becoming the go-to for Canadian homeowners.

The “Hot Rate” Drop: Breaking Down the Numbers

For the first time in a long time, we are seeing rates dip significantly below the 4% threshold for long-term fixed products. Here is the current landscape of the lowest mortgage rates in Canada as offered by Ratehub.ca:

- 5-Year Fixed Rate: 3.84%

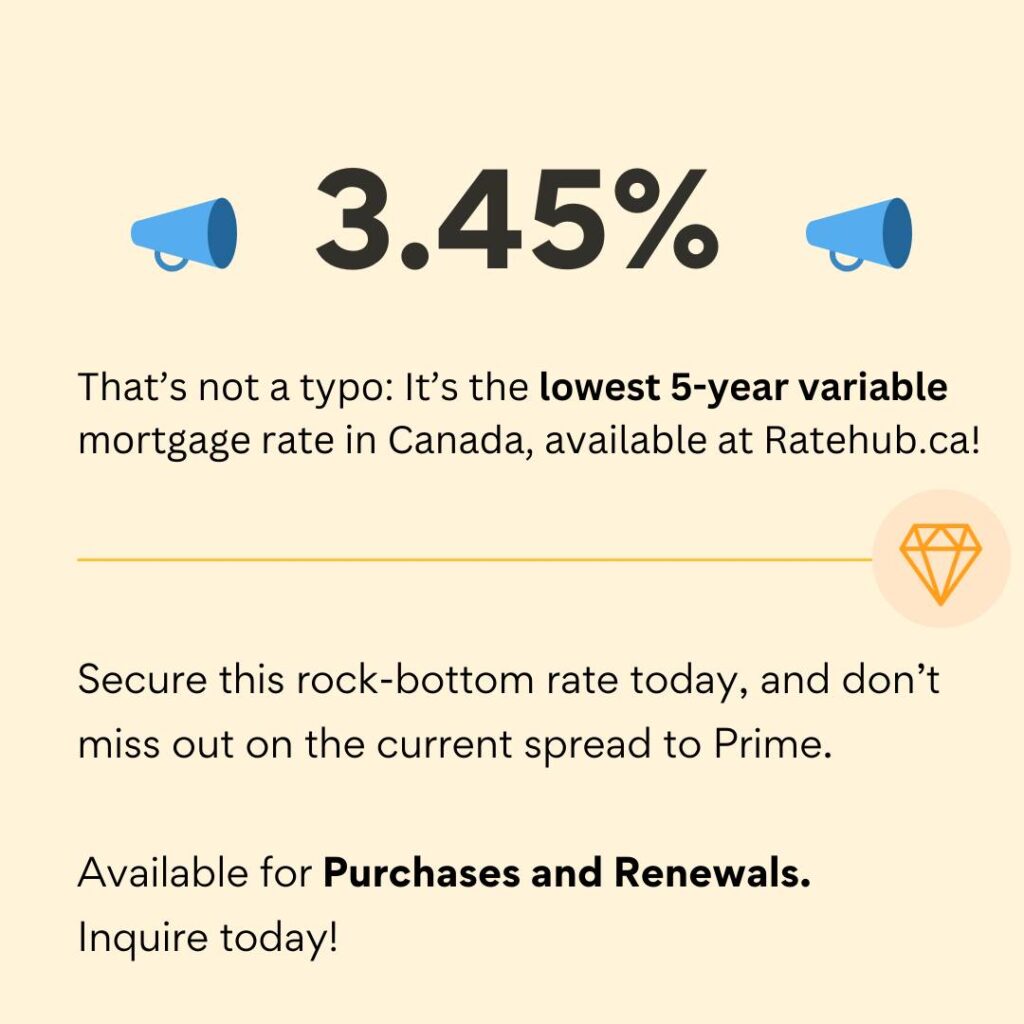

- 5-Year Variable Rate: 3.45% (Exclusive Rate)

Why 3.84% is a Big Deal

In a volatile market, a fixed rate provides the “sleep at night” factor. It locks in your payment for 60 months, protecting you from any potential inflation spikes. At 3.84%, the monthly payment on a standard Canadian mortgage becomes significantly more manageable compared to the 5% or 6% rates we saw throughout 2023 and 2024.

The Variable Advantage at 3.45%

For those who believe the Bank of Canada will continue to lower its benchmark rate, the exclusive 3.45% variable rate is even more aggressive. While variable rates carry more risk if the economy fluctuates, starting at a base of 3.45% gives you a massive head start on interest savings.

The $13,000 Difference: Ratehub vs. The Big Banks

Many Canadians have a “loyalty bias.” We tend to stay with our current bank when our mortgage comes up for renewal because it feels easier. However, that loyalty is often expensive.

Data shows that by switching to a specialized provider like Ratehub.ca rather than simply signing a renewal offer from a major bank, homeowners can save an average of $13,000 over the life of their term.

How do they do it?

Ratehub.ca operates with a high-volume, digital-first model. Unlike traditional banks with massive overhead from physical branches, Ratehub passes those savings directly to the consumer in the form of lower interest rates. As Canada’s largest online mortgage company, they have the leverage to negotiate rates that individual consumers simply can’t access on their own.

Why Trust Ratehub.ca? (The Credentials)

When dealing with the largest financial transaction of your life, trust is non-negotiable. While the “lowest mortgage rate in Canada” might get you through the door, it’s the service and reliability that close the deal.

Ratehub.ca (and its mortgage brokerage arm, formerly known as CanWise) has built a reputation as the gold standard in Canadian digital lending:

- Brokerage of the Year: They were named Canada’s Brokerage of the Year for four consecutive years (2018–2021).

- Proven Volume: They have funded over $16 Billion in mortgages. This isn’t a small “fintech” startup; it is a massive financial engine.

- Customer Satisfaction: With over 10,000 reviews across Google and Facebook, they maintain a staggering 4.9-star rating. In the world of finance, where complaints are common, this level of satisfaction is nearly unheard of.

- Deep Experience: With 12 years in the industry, they bridge the gap between high-tech online applications and expert offline service.

Buying vs. Renewing: What Should You Do?

The strategy for snagging the lowest mortgage rate depends on your current situation.

If You Are a First-Time Home Buyer

This 3.84% rate could be the difference-maker for your “Stress Test.” In Canada, you must prove you can handle payments at a rate 2% higher than your actual rate. A lower base rate (3.84%) makes it easier to qualify for a larger loan, potentially moving you from a one-bedroom condo to a townhouse.

If You Are Renewing

Don’t wait for your bank to call you 30 days before your term ends. Most banks will offer you their “posted rate” or a slight discount. By comparing your renewal offer against Ratehub’s 3.84% fixed rate, you gain immediate leverage. If your bank won’t match it, switching is often a seamless process handled entirely by the Ratehub team.

Is This Rate Here to Stay?

The short answer: Probably not.

The mortgage market in Canada has been incredibly volatile. Bond yields (which influence fixed rates) have been moving up and down based on every new inflation report and employment data release. Ratehub has explicitly stated that this 3.84% offer is a limited-time rate.

Given the current economic climate, we don’t know how long the “window” for sub-4% rates will remain open. If you are within 120 days of your renewal or actively house hunting, locking in a pre-approval at this rate is a smart defensive move.

How to Apply for the Lowest Rate

The process of securing the lowest mortgage rate in Canada has been modernized to fit into a busy lifestyle.

- Online Comparison: Visit Ratehub.ca/best-mortgage-rates to see how the 3.84% rate compares to other products (3-year fixed, 10-year fixed, etc.).

- Instant Quote: You can get a personalized quote in minutes by providing basic details about your property and credit score.

- Expert Guidance: Once you apply, you aren’t just left with an algorithm. Ratehub’s award-winning mortgage experts guide you through the paperwork, the “fine print,” and the closing process.

Final Thoughts: Don’t Leave Money on the Table

In 2026, every dollar counts. With the cost of living remaining a top concern for Canadian families, your mortgage is the single biggest area where you can find “found money.“

Saving $13,000 isn’t just a marketing slogan, it’s the reality of what happens when you stop paying the “convenience tax” to big banks and start shopping for the lowest mortgage rate in Canada.

If you’ve been waiting for a sign to act on your mortgage, a 3.84% fixed rate is it. Compare, apply, and lock it in before the market shifts again.