Are you planning to buy a home in the Greater Toronto Area (GTA) this year? Before you sign on the dotted line, you need to look at the hard data. The Toronto Regional Real Estate Board (TRREB) has released its final Market Watch report for December 2025, and it reveals a market in the middle of a massive recalibration.

For savvy buyers and those looking for the best mortgage rates in Ontario, 2026 presents a landscape we haven’t seen in years: one where buyers finally have the upper hand.

The $1 Million Benchmark: Prices are Trending Down

The most significant takeaway from the year-end report is the cooling of prices. For the calendar year 2025, the average selling price in the GTA was $1,067,968, which is a 4.7% decrease from the 2024 average of $1,120,241.

By December 2025, the average price dipped even further to $1,006,735. This shift is critical for those entering the market, as it moves the average closer to the psychological $1 million mark, potentially saving buyers over $50,000 compared to just one year ago.

Inventory Surges: You Have More Choice Than Ever

One of the biggest hurdles for buyers in the past was the lack of inventory. That changed in 2025. By the end of December, active listings reached 17,005, representing a 17.5% increase year-over-year.

With 186,753 new listings hitting the market throughout the year (up 10.1%), the power has shifted. TRREB CEO John DiMichele noted that this elevated inventory is “allowing for selling prices to be negotiated downward,” which is music to the ears of any first-time home buyer in Ontario.

Mortgage Rates and Financing: What to Expect in 2026

While prices are down, the cost of borrowing remains a central focus. As of November 2025, the Bank of Canada Overnight Rate was 2.3%, with the Prime Rate at 4.5%.

For those looking to secure the lowest mortgage rates in Canada, here were the average benchmarks at the end of 2025:

- 1-Year Mortgage Rate: 5.84%

- 3-Year Mortgage Rate: 6.05%

- 5-Year Mortgage Rate: 6.09%

If you are considering a home equity line of credit (HELOC) in Ontario or looking to refinance a mortgage in Canada, these rates suggest a stabilizing environment. However, many buyers are still turning to a top-rated mortgage broker in Toronto to find private lending options or better terms than the big banks offer.

Market Speed: The “Wait and See” Effect

Homes are staying on the market longer, giving you more time to do your due diligence. In December 2025, the Average Property Days on Market (PDOM) rose to 65 days, an 18.2% increase from the previous year.

This slower pace is largely due to “economic uncertainty” and a higher Toronto unemployment rate, which sat at 8.7% in October 2025. As TRREB Chief Information Officer Jason Mercer points out, households must be confident in their jobs before committing to “long-term monthly mortgage payments”.

Regional Breakdown: Where are the Best Deals?

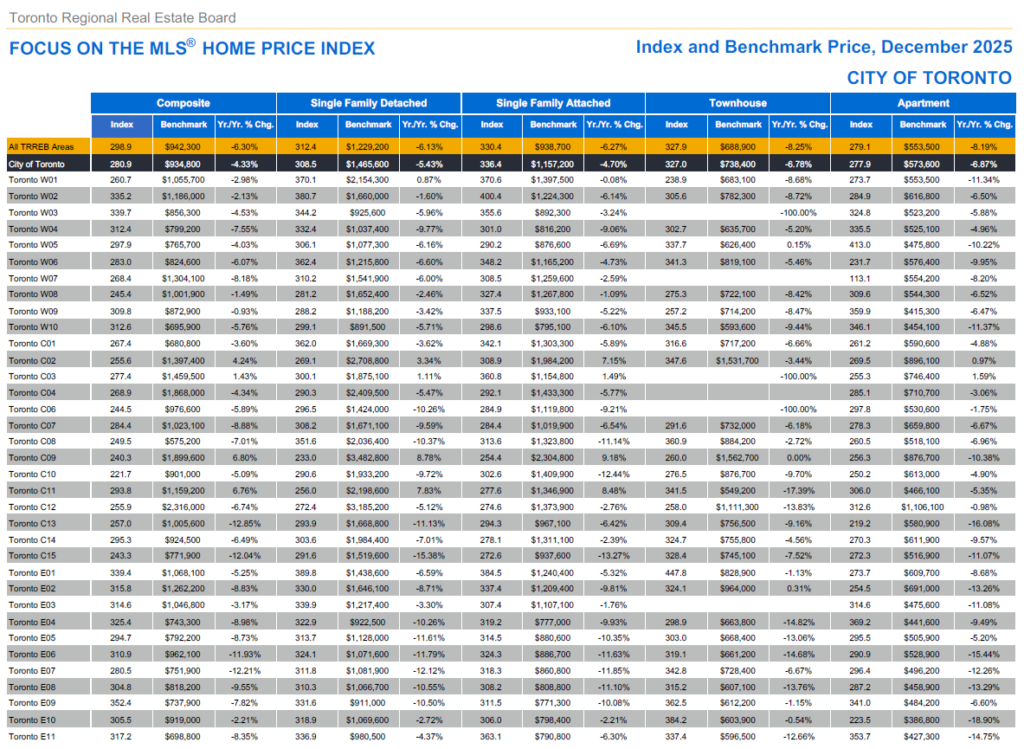

Not all areas are created equal. If you are looking for a real estate investment in Toronto, pay attention to the regional price differences in December 2025:

- City of Toronto (416): Average price $986,542 (Down from $1M+ peaks).

- Peel Region: Average price $937,012.

- Durham Region: Average price $844,473.

- Halton Region: Still the most expensive at $1,120,811.

The 905 area suburbs saw a sharper decline in detached home prices (-7.0%) compared to the City of Toronto (-4.5%), making the suburbs a prime target for families seeking value.

Expert Advice for 2026 Buyers

TRREB President Daniel Steinfeld believes that “improved affordability has set the market up for recovery”. This means the current dip may be a window of opportunity before “pent-up demand” is satisfied and prices begin to climb again.

Before you sign your contract in 2026, keep these tips in mind:

- Shop for Rates: Don’t settle for the first offer. Compare private mortgage lenders in Toronto and traditional banks to find the most flexible terms.

- Negotiate Hard: With 17,000 active listings, you have leverage. Use the 65-day average market time to negotiate on price or conditions.

- Check the Employment Outlook: Ensure your financial foundation is solid. With 2.2% inflation and shifting employment, a stable income is your best asset when securing a personal loan in Canada or a mortgage.

Conclusion

The 2025 TRREB report clearly shows a market that has cooled, offering a rare entry point for those who have been priced out. Whether you are looking for commercial real estate in Toronto or your very first condo, 2026 is the year to be a meticulous, data-driven buyer.