For anyone navigating the Greater Toronto Area (GTA) real estate market, the Bank of Canada (BoC) interest rate announcements are the most critical dates on the calendar. As we move into 2026, the BoC’s decisions will directly dictate the best mortgage rates in Ontario and influence whether the “Affordability Shift” seen in the TRREB December 2025 report continues.

With the Bank of Canada Overnight Rate sitting at 2.25% as of early 2026, many are looking to see if further cuts, or potential hikes, are on the horizon.

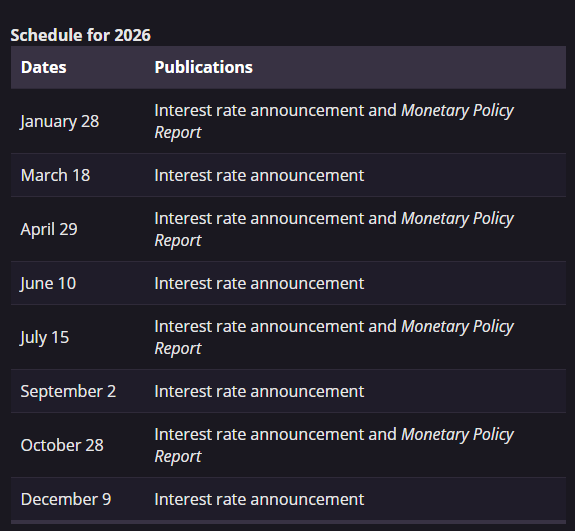

Official Bank of Canada 2026 Announcement Schedule

The Bank of Canada reviews its interest rates eight times a year. All announcements are scheduled for 9:45 a.m. ET. Mark these dates if you are planning to refinance a mortgage in Canada or apply for a personal loan in Canada:

- Wednesday, January 28* (Includes Monetary Policy Report)

- Wednesday, March 18

- Wednesday, April 29* (Includes Monetary Policy Report)

- Wednesday, June 10

- Wednesday, July 15* (Includes Monetary Policy Report)

- Wednesday, September 2

- Wednesday, October 28* (Includes Monetary Policy Report)

- Wednesday, December 9

*Denotes dates when the Bank also publishes its quarterly Monetary Policy Report (MPR), providing deeper insight into inflation and economic growth.

Why These Dates Matter for the Toronto Market

According to the TRREB December 2025 Market Watch, the GTA market is currently in a state of “rebalancing“. The average selling price in December 2025 was $1,006,735, a 5.1% decline from the previous year.

However, high inventory (17,005 active listings) and a Toronto unemployment rate of 8.7% have kept many buyers on the sidelines. Each BoC announcement in 2026 serves as a potential “trigger” for these buyers. If the BoC maintains its “easing bias,” we may see the lowest mortgage rates in Canada drop further, finally unlocking the “pent-up demand” TRREB President Daniel Steinfeld has noted.

3. Mortgage Rates and Your 2026 Strategy

As of late 2025, the benchmark mortgage rates were:

- 1-Year Mortgage Rate: 5.84%

- 3-Year Mortgage Rate: 6.05%

- 5-Year Mortgage Rate: 6.09%

For those seeking a home equity line of credit (HELOC) in Ontario or looking for real estate investment opportunities in Toronto, these fixed dates are your window to lock in rates. Many investors are currently consulting a top-rated mortgage broker in Toronto to time their purchases around the March and June announcements, which are historically high-volume periods for the spring market.

4. Economic Headwinds: Inflation and Employment

The BoC’s 2026 path depends on two main factors: Inflation and GDP growth. In October 2025, inflation sat at 2.2%, very close to the 2% target. While this suggests rates could stay low, the Bank remains cautious about “global uncertainty” and “volatile trade“.

If you are a first-time home buyer in Ontario, these announcements will determine your “stress test” requirements. A lower policy rate makes it easier to qualify for a larger loan, even if you are looking at private mortgage lenders in Toronto for more flexible financing.

Conclusion: Stay Informed with Barhoot.com

Whether you are managing commercial real estate in Toronto or just trying to find the best car insurance in Ontario, interest rates affect every part of your financial life. The 2026 schedule is your roadmap to financial planning in a shifting economy.

For the latest updates on every Bank of Canada rate announcement and how it impacts your wallet, keep following barhoot.com.