The Canadian labour market started 2026 with a “mixed bag” of results. According to the Statistics Canada Labour Force Survey released on February 6, 2026, the national unemployment rate dropped to 6.5%, its lowest level since September 2024.

However, this drop wasn’t due to a hiring surge, it was driven by a significant decline in the number of people actively looking for work.

National Employment Highlights

| Metric | January 2026 | Change from Dec 2025 |

| Unemployment Rate | 6.5% | ↓ 0.3% |

| Employment Change | -25,000 | ↓ 0.1% |

| Participation Rate | 65.0% | ↓ 0.4% |

| Avg. Hourly Wage | $37.17 | ↑ 3.3% (YoY) |

Key Trends and Sector Shifts

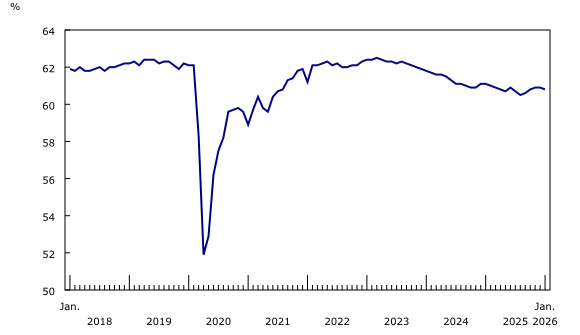

The Participation Gap

The headline unemployment rate fell because the labour force shrank by 94,000 people. This represents the largest drop in the participation rate in several years, particularly in Ontario. Analysts suggest “collapsing population growth” means fewer jobs are now required to keep the unemployment rate steady.

Full-Time vs. Part-Time

While the economy shed 25,000 jobs overall, the quality of employment showed resilience:

- Full-time work: Increased by 45,000 positions.

- Part-time work: Plunged by 70,000 positions.

- Compared to 12 months ago, Canada has added 149,000 full-time jobs, indicating a shift toward more permanent roles despite the headline decline.

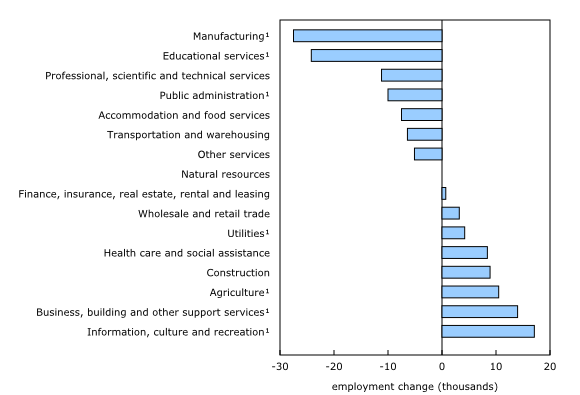

Sector Breakdown: Manufacturing Under Pressure

The manufacturing sector took the hardest hit, losing 28,000 jobs in January. This industry is down 51,000 positions year-over-year, largely attributed to the impact of U.S. tariffs on Canadian exports. Conversely, gains were seen in:

- Information, culture, and recreation (+17,000)

- Business and building support services (+14,000)

- Agriculture (+11,000)

Regional Performance

| Province | Unemployment Rate (Jan) | Monthly Change | Employment Change |

| Ontario | 7.3% | ↓ 0.6% | ↓ 67,000 |

| Alberta | 6.4% | ↓ 0.3% | ↑ 20,000 |

| Saskatchewan | 5.3% | ↓ 1.1% | ↑ 6,100 |

| Quebec | 5.2% | ↓ 0.1% | ↑ 4,600 |

| BC | 6.1% | ↓ 0.2% | ↑ 2,900 |

Ontario felt the brunt of the manufacturing decline, losing 67,000 jobs. Meanwhile, Alberta continues to be a growth engine, adding 86,000 jobs over the last year.

Worker Sentiment: The “Tariff Uncertainty” Effect

A new trend emerged in January: workers in export-dependent industries are becoming more restless. Approximately 5.4% of permanent employees in sectors reliant on U.S. demand plan to leave their jobs in the next year, a notable increase from 2025. This suggests that trade uncertainty is beginning to influence career planning across the country.