If you’ve checked your mortgage statement, looked at a house listing, or even just glanced at your credit card bill lately, you know the feeling. We are all stuck in a giant financial waiting room.

Ever since the Bank of Canada (BoC) started its aggressive rate-hiking marathon to fight inflation, you know when they dropped the ball and made all of us consumers pay the price, the same three questions have been on everyone’s mind: Is the BoC going to increase again? Are they finally going to cut? Or are we just going to hold steady for the foreseeable future?

For those of us in the real estate market, whether you’re a first-time buyer trying to get in or a homeowner staring down a renewal, the stakes couldn’t be higher.

We’re all looking for that one bit of “positive news” that says relief is on the way. But with the economy sending mixed signals, finding a straight answer feels like trying to hit a moving target.

In this article, we’re going to cut through the jargon and look at what’s actually happening. We’ll break down the latest forecasts and, more importantly, what they mean for your wallet, your home, and your peace of mind.

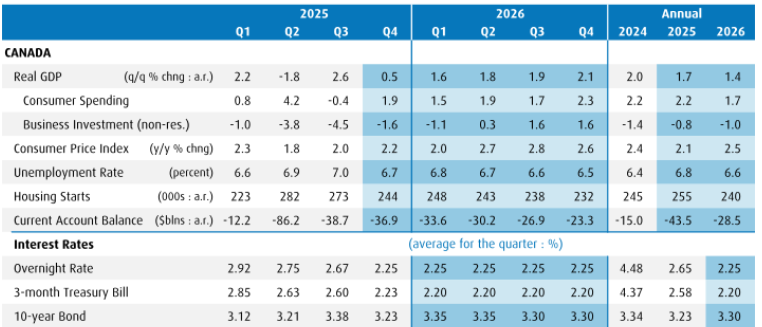

BMO: Expected a Decrease or Hold in Interest Rates In 2026

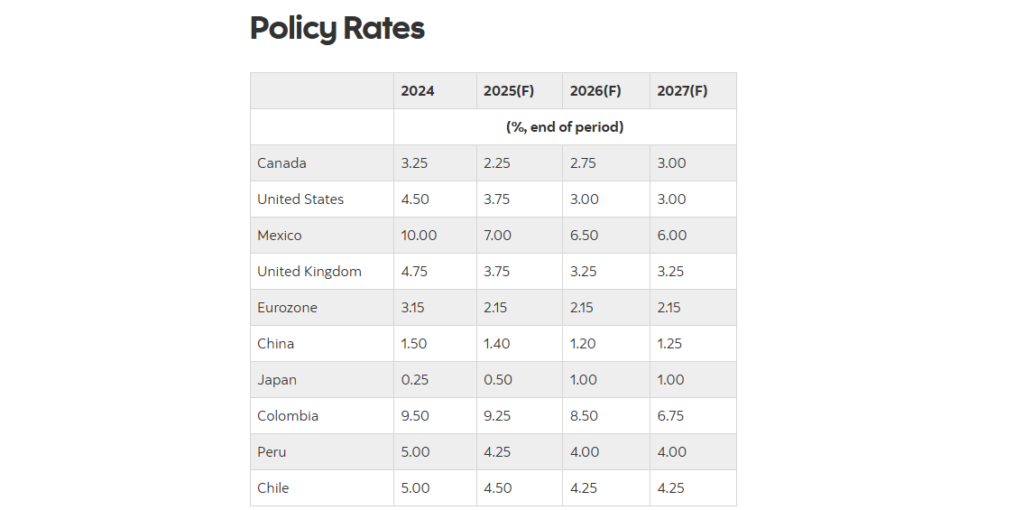

BMO Economics indicates that while the Bank of Canada (BoC) may pause its aggressive cutting cycle, the bias remains toward lower rates if economic growth remains sluggish. Their analysis suggests the BoC could implement further modest cuts in early 2026 to reach a “neutral” level of approximately 2.25%. BMO notes that the primary driver for any additional decrease would be a need to support a softening labor market and address weak domestic demand.

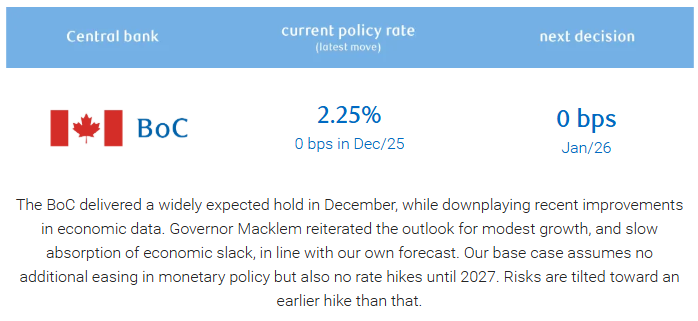

RBC: Expected a Hold in Interest Rates In 2026

RBC Economics forecasts that the Bank of Canada will remain on hold throughout 2026. Their outlook suggests that after the significant easing seen in 2024 and 2025, the central bank will enter a period of stability to assess the impact of previous cuts. RBC expects the overnight rate to stay steady as the BoC balances persistent services inflation against a low growth economic environment.

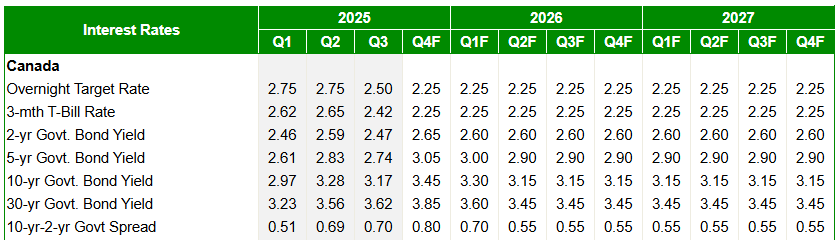

TD: Expected a Hold in Interest Rates In 2026

TD Economics views 2026 as a year of stability, expecting the Bank of Canada to maintain a hold on interest rates at 2.25%. Their long-term forecast suggests that by 2026, the economy will have reached a sustainable equilibrium where further cuts are unnecessary, but inflationary risks, particularly regarding trade and fiscal policy, will prevent any immediate increases.

CIBC: Expected an Increase or Hold in Interest Rates In 2026

CIBC Capital Markets suggests that the “rate cutting line” has ended, and the next likely move for the BoC in 2026 is either a hold or a strategic increase. CIBC analysts note that if the Canadian economy rebounds more quickly than anticipated in the first half of 2026, the Bank may need to raise rates to prevent the economy from overheating. They emphasize that the 2.25% level is likely the floor for this cycle.

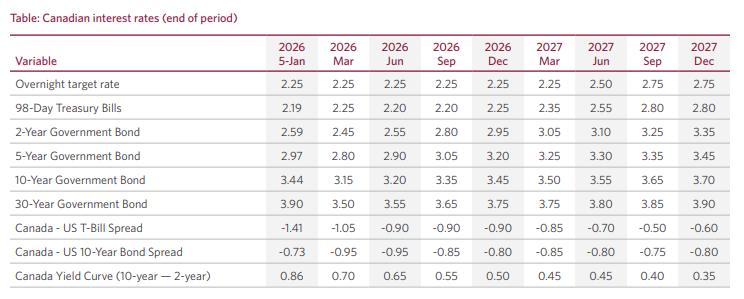

Scotiabank: Expected an Increase in Interest Rates In 2026

Scotiabank Economics expects an increase in interest rates during 2026. Their forecast snapshot indicates that the Bank of Canada will likely pivot from its holding pattern to a tightening phase in the second half of the year. Scotiabank argues that with inflation remaining “sticky” near the top of the target range and a resilient labor market, the BoC will need to raise the policy rate by roughly 50 basis points to return to a truly neutral stance.

National Bank: Expected an Increase in Interest Rates In 2026

National Bank of Canada expects the Bank of Canada to start increasing interest rates in the fall of 2026. While they see the Bank remaining on hold for the first half of the year at 2.25%, their macro outlook is consistent with rate hikes beginning in Q4 2026. This forecast is driven by an “impressive pace of job growth” and the belief that the worst of the economic slowdown is over, shifting the Bank’s focus from easing to tightening.

At the end of the day, we’re all looking for a bit of certainty in an uncertain market.

Whether the BoC decides to hold the line or finally gives us that much-anticipated cut, the best thing you can do right now is stay informed and stay flexible.

The “wait and see” approach works for some, but for others, especially those with renewals coming up in 2026, the clock is ticking. Are you planning to lock in a rate now, or are you betting on a dip later this year?